Goldman Sachs Analysts: Biggest Risks to COVID Vaccination Targets in US, Europe Are Confidence-Related

Goldman Sachs analysts have updated and expanded their popular research detailing the outlook for vaccine rollout in both the US and internationally. As the FDA prepares to grant the virtually inevitable approval of the Moderna mRNA COVID vaccine later this week, the investment bank has expanded its monthly forecasting vaccination model by including the major emerging markets and the ten leading global vaccine candidates.

Looking further down the road, more analysts have been discussing the prospect that we might actually see a glut of vaccine doses sooner than many had expected (at least, in the wealthy countries that have managed to strike distribution deals with the vaccinemakers, and aren’t relying on Bill Gates and the WHO to bail them out).

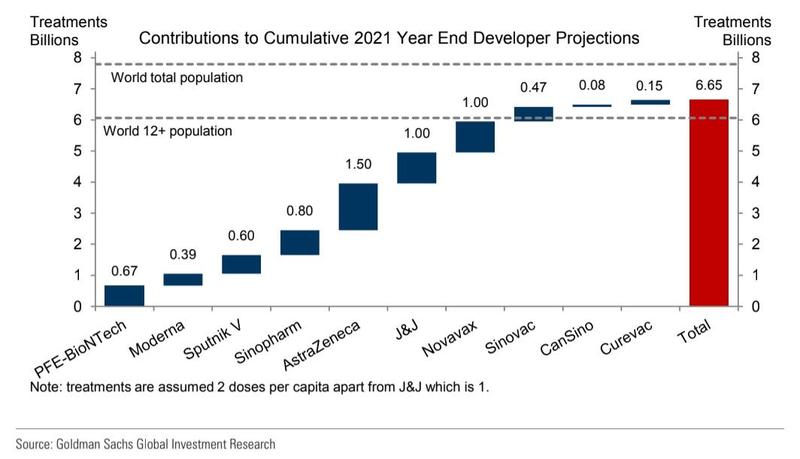

Should the “top 10” developers achieve their production targets (note: Pfizer has already cut its 2020 year-end deliver target in the US by 50%) enough doses could be delivered to vaccinate 85% of the world’s population by the end of next year.

Speaking of the Pfizer target cuts, one of the most important differences in Goldman’s latest update is that the bank and its analysts have tweaked their models to account for the stage of a company’s trial, as well as – and this is important – the company’s experience in mass production.

These “tweaks” are an attempt to “account for potential production misses,” according to the authors of the research.

Additionally, the bank’s analysts have taken the liberty of “allocating” all the non-committed doses to account for likely future contracts between developers and nations (presumably these are based on media reports and other chatter/speculation).

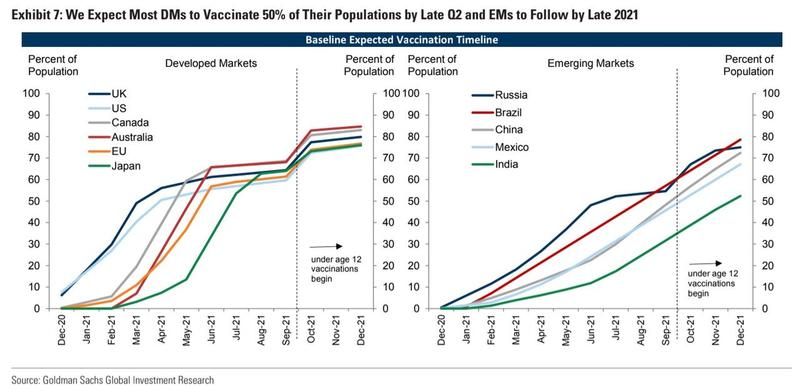

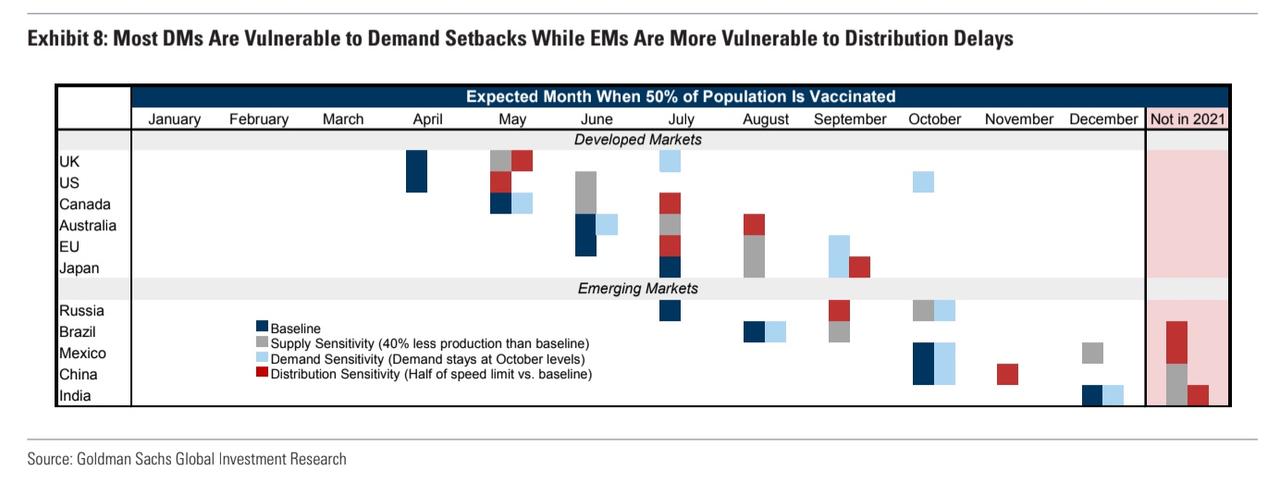

But assuming all the vaccinemakers meet their various development targets (which, if the past is any guide, probably won’t happen) Goldman believes it’s “realistic” to expect 50% of the developed world population to be vaccinated by April, including for the US and the UK, May for Canada, June for the EU and Australia, and July for Japan.

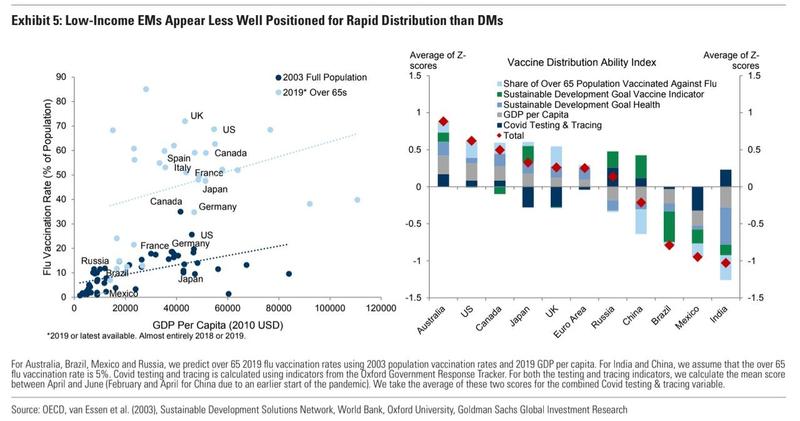

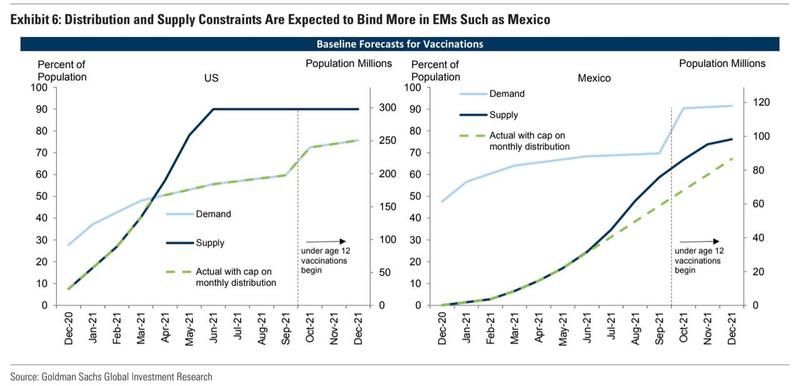

Most larger EM countries can expect to meet the 50% threshold sometime during the second half of 2021. While Goldman expects its DM projections to be more “resilient”, EM production targets, due to various vagaries surrounding their capacity for storage and distribution, are more “vulnerable” to being thwarted.

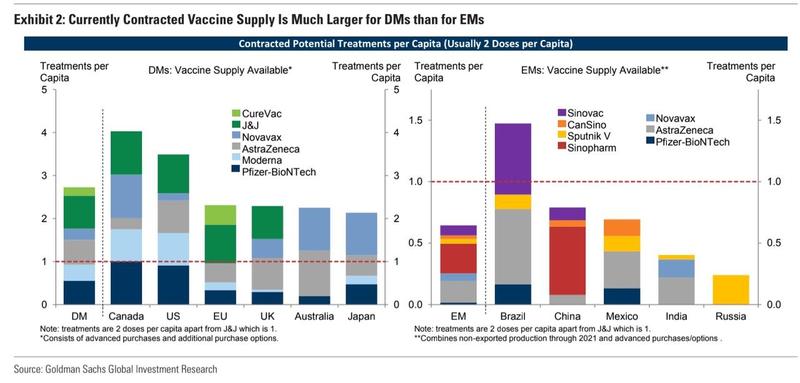

Whatever ultimately happens, Goldman expects that no matter what, supplies in the emerging world will always trail the developing world, and – more importantly – the developing world won’t see its vaccination rate really begin to rise until after the developed world has ensured its citizens get all the first helpings.

In one of the more interesting charts breaking down obstacles to official vaccination targets in various DM and EM countries, Goldman points out, ever so diplomatically, that “demand issues” are the biggest issue in the US, while “supply issues” are the biggest problem in EM.

And by “demand issue”, the bank means that not enough people will voluntarily go get vaccinated, for whatever reason – whether it’s a lack of “confidence” in safety and efficacy, or perhaps a financial reason (even though lawmakers and the president have repeatedly promised that all that would be ‘free to all’).

Finally, the bank’s analysts apparently felt obliged to highlight one risk that could seriously delay the global rollout, both in the developed world, but – more seriously – in the developing world: and that would be if the three leading adenovirus-vector vaccines – AstraZeneca, Johnson & Johnson, CanSino – don’t succeed in meeting their efficacy targets.

After all, AZ did everything it could to mask the surprisingly low headline efficacy number (under 70%) from its Phase 3 trials, which were plagued by halts and suspicions about serious side effects in a small number of subjects (though so far there has been nothing to affirm that the vaccine was directly involved). And while Russia has boasted about high efficacy figures for “Sputnik 5”, the adenovirus vaccine developed by the Gamaleya institute, we imagine most American bankers are taking those numbers with a grain of salt.

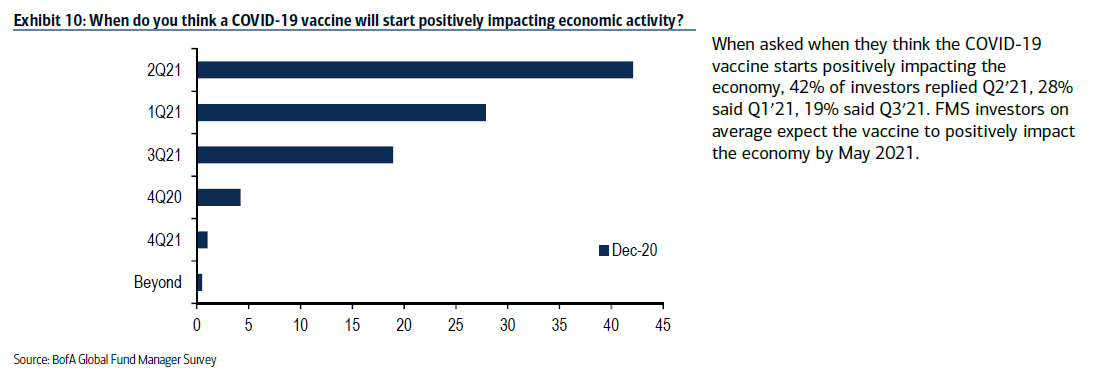

Still, Goldman says its outlook for the vaccine rollout undergirds its call for a strong rebound in economic growth next year. And they’re not alone: according to the latest BofA fund managers’ survey, virtually all the professional money managers surveyed expect the positive impact from the vaccines to be felt next year, with more than 40% believing that a “positive impact” will begin during Q1.

The question is: should they feel the same way about AstraZeneca’s results?

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

Featured image is by Viacheslav Lopatin (Credit: scaliger – stock.adobe.com)

*** This article has been archived for your research. The original version from Global Research can be found here ***