Davos’ false promise of a “Great Reset” reveals fear of revolution

The past few years of political turbulence have troubled the ruling class. They are facing unprecedented waves of protests and instability. They are now increasingly desperately trying to stabilise the situation using state expenditure and other concessions. This was seen at the World Economic Forum last month.

The snowy hills of Davos are visited by the world’s rich and powerful once a year for the World Economic Forum. This year the pandemic forced them online. This online event obviously wasn’t the full $19,000/ticket circus that usually lands in the Swiss Alps. It was a scaled-down, public event, with none of the ‘off the record’ conversations or networking.

In spite of this, the event was attended by elected and unelected heads of government from all over the world as well as CEOs of major multinational corporations.

The theme of this event was “The Great Reset”. It was named after founder Klaus Schwab’s book from this summer, kindly co-sponsored by the Prince of Wales, Charles Windsor, the heir to the English throne. The book made the rounds, and even prompted a wave of conspiracy theories around it, including right-wing commentators not quite being able to decide whether they think it’s quasi-fascism or communism (Rowan Dean on Australian Sky News, for example). Of course, it is neither.

Schwab and his co-thinkers are worried about the lack of progress in dealing with issues such as climate change and inequality. They see the response to the pandemic as an opportunity to “reset” capitalism and return some stability. The warning they give is that it is a question of change or be changed:

“Failing to address and fix the deep-rooted ills of our societies and economies could heighten the risk that, as throughout history, ultimately a reset will be imposed by violent shocks like conflicts and even revolutions. It is incumbent upon us to take the bull by the horns. The pandemic gives us this chance: it ‘represents a rare but narrow window of opportunity to reflect, reimagine and reset our world’.”

It is quite a stark warning to the world ruling class: If you proceed along the same path as you have since the 1980s, you will face violent conflicts, and even revolutions. This is an opportunity to change, and it’s high time to seize it, Schwab argues.

What is the remedy that is offered? Schwab offers a “stakeholder capitalism” where shareholders aren’t always put first, but instead all stakeholders should be considered, including the environment, workers and consumers. The kind of measures that are being talked about are environmental taxes, business taxes, education and massive green investment.

In many ways they are echoing sentiments put forward by the IMF, the UN and other big international institutions that have been insisting on massive investments in healthcare to deal with the pandemic, as well as massive deficit spending.

The pandemic effect and ditching Freidman

When the pandemic broke out in earnest in March last year, the ruling class had their backs against the wall. They could either face a collapse of healthcare systems, social care systems and many other aspects of civilised society, they could shut down the economy and let millions go unemployed, or they could issue vast amounts of debt to bankroll the economy whilst waiting for a vaccine. In the end they chose the latter.

The capitalists bankrolled the economy during the pandemic and amassed huge debt rather than let the system collapse / Image: Paul Kagame, Flickr

The capitalists bankrolled the economy during the pandemic and amassed huge debt rather than let the system collapse / Image: Paul Kagame, Flickr

Over the past year, governments have spent more money than ever before in peacetime, more than double what they spent in the crisis of 2008-9. Massive deficits have been built up with no prospects of balancing the books in sight. Government debt will reach record highs this year, even higher than at the end of the Second World War. Central banks printed trillions to keep corporations and governments afloat, much of which will never be paid back. Fearing that the bubble will burst, they have reinflated the bubble even further.

What we have is a wholescale swing to Keynesianism. Suddenly people like Krugman are the flavour of the month, and there is even a rising interest in the wishful-thinking economics of Modern Monetary Theory.

This is a significant shift. For decades the ideas of Milton Friedman dominated the thinking of the capitalist class. He thought the Great Depression was caused by government mismanagement and generally that the less governments do, the better. This was also hugely beneficial for ‘the bottom line’, that is the profits. We were told that if the rich get really rich then some of that wealth would ‘trickle down’ to the poorer in society. This was a lie, of course, but it was an official lie, taught at every economics class in the world. The state was bad, private enterprise good.

The collapse of the Lehman brothers in 2008 put a big question mark on that idea. Suddenly, all the banks were running to the state for hand-outs. The bigger and more outrageous the demand, the more likely it was to be granted. The big financial institutions held governments hostage, threatening collapse and calamity if they weren’t given hundreds of billions of dollars, which they were indeed granted. So much for ‘free’ enterprise.

When Monetarism and Friedman were at their peak in the mid-1990s, Ted Grant predicted their coming demise:

“‘Every action has an equal and opposite reaction.’ This law applies not only to physics but to society. The drive towards privatisation will reach its limits. This is already beginning to happen in Britain. At a certain stage, the tendency towards statisation will reassert itself.” (Ted Grant – The Collapse of Stalinism and the Class Nature of the Russian State)

In reality, this revealed what the financial markets had clearly taken for granted, which is that some banks were simply too big to fail, and the state (government and central bank) was the last guarantor of the banking system. For decades, governments and media commentators had been insisting that there was no money for hospitals, schools, sick pay, etc. Now, suddenly, there were hundreds of billions available for the banks.

Ben Bernanke, then the chair of the Federal Reserve, privately expressed that he was surprised at the time that there wasn’t more of a backlash, but he recognised that it came after a delay, starting with movements like Occupy Wall Street. This early lack of a response from the working class probably gave the ruling class the confidence to take more audacious measures.

From around 2010 onwards, after the initial shock settled, there was a determined effort to make the workers pay for the crisis through austerity. This affected most obviously the public sector workers, but it also had a severe impact on private sector workers. Casualisation, attacks on pensions and work benefits as well as wages all fed what the media called ‘the populist backlash’.

In Marxist terms what was taking place was the following. Capitalist society was severely shaken by the crisis of 2008, starting with the economy. In order to try to patch up the economic situation, companies and governments launched an assault on workers’ conditions and the welfare state. This then led to waves of mass protests and great electoral instability, with voters switching to new parties, and old parties being discarded or transformed. Thus, the old political order was being destroyed. In other words, the attempt to restore the economic equilibrium upset the political and social equilibrium. The capitalist class and their representatives would, however, pay for their overconfidence.

The IMF produced an index of mass protests this summer. It was the first time they have done this, and it was clearly an attempt to understand the pace of events. Using a vast database of newspaper articles in multiple languages, they modelled the rise and fall of protest movements since the 1980s. Unsurprisingly, 2019 saw a culmination of the biggest wave of protests in the index, spread all across the world. The only period approaching that level of protest was during the Arab Spring, but that was less widespread.

Rising instability

Referring to how the index had developed in 2020, the IMF commented in its World Economic Outlook in October that protests had abated because of the pandemic, but they did not think this would last:

“It is reasonable to expect that, as the crisis fades, unrest may reemerge in locations where it previously existed, not because of the COVID-19 crisis per se, but simply because underlying social and political issues have not been tackled. The threats may also be bigger where the crisis exposes or exacerbates problems, such as a lack of trust in institutions, poor governance, poverty, or inequality.”

Yet even during the pandemic, 2020 saw possibly the biggest protests ever in the US, with tens of millions participating in the Black Lives Matter protests, which incidentally makes the Trump supporters that stormed the capitol look rather pathetic by comparison. If 2020 was a bad year for political stability, as the IMF points out, the coming years are likely to be worse.

Trust in the establishment is at an all-time low. In a poll carried out by Edelman PR in 27 countries, 57-59 percent think that the government leaders, businesses leaders and journalists are purposely misleading people. A deep worry about the future is underlying this: 84 percent are concerned about job losses (53 percent are fearful); 54 percent work in a company where there have been job losses or where workers have had reduced hours; 56 percent worry that the pandemic will accelerate the rate at which workers are replaced by AI or robots.

Last year, before the pandemic, the same PR firm revealed that 56 percent of respondents thought that “Capitalism today does more harm than good in the world”, 74 percent expressed a sense of injustice, 73 percent a desire for change and 48 percent that “the system is failing me”.

It isn’t just protests, however, the same malaise in bourgeois society is evident in parliament. The rapid swings of public opinion and increasing polarisation are destabilising parliaments everywhere. In the west, the most striking example is that of the US where something like two-fifths of Congress voted not to recognise the outcome of the presidential election and the majority attempted to impeach the outgoing president for organising an insurrection. The only precedent for this event that historians could think of is the period leading up to the US civil war. That is, the period leading up to the Second American Revolution.

In 1915, Lenin describes the conditions of a revolutionary situation:

“[W]hen it is impossible for the ruling classes to maintain their rule without any change; when there is a crisis, in one form or another, among the ‘upper classes’, a crisis in the policy of the ruling class, leading to a fissure through which the discontent and indignation of the oppressed classes burst forth.” (Lenin: 1915/csi: II)

He describes how this took place during the First World War, and some of it rings very true for the situation today:

“A political crisis exists; no government is sure of the morrow, not one is secure against the danger of financial collapse, loss of territory, expulsion from its country (in the way the Belgian Government was expelled). All governments are sleeping on a volcano; all are themselves calling for the masses to display initiative and heroism. The entire political regime of Europe has been shaken, and hardly anybody will deny that we have entered (and are entering ever deeper—I write this on the day of Italy’s declaration of war) a period of immense political upheavals.” (Ibid)

Obviously, the crisis at that time was particularly acute because of the war, but much of it could be written about today. Indeed, much has been made of how the pandemic is similar to a situation of war, and that holds true, within certain limits. Lenin continues:

“The conflagration is spreading; the political foundations of Europe are being shaken more and more; the sufferings of the masses are appalling, the efforts of governments, the bourgeoisie and the opportunists to hush up these sufferings proving ever more futile. The war profits being obtained by certain groups of capitalists are monstrously high, and contradictions are growing extremely acute. The smouldering indignation of the masses, the vague yearning of society’s downtrodden and ignorant strata for a kindly (“democratic”) peace, the beginning of discontent among the ‘lower classes’—all these are facts. The longer the war drags on and the more acute it becomes, the more the governments themselves foster—and must foster—the activity of the masses, whom they call upon to make extraordinary effort and self-sacrifice.” (Ibid)

Much of this could be said about the present situation, but in the advanced capitalist countries, the same acuteness of suffering is not present. There really is only one reason for that, and that is that the ruling class understood at the outset that this would be a recipe for even more intense class struggle than what has already taken place. It was simply politically impossible, not to mention unprofitable, to allow mass unemployment to develop without any kind of safety net.

Spend, spend, spend!

From there, we get a dramatic change in attitude across the political spectrum. Suddenly, government was no longer a dirty word. In fact, it was being called upon to rip up any kind of rules that had guided its activities since the 1980s.

We have the remarkable situation in which Trump and the Republicans created the biggest welfare programme in the US in decades. Unemployment benefit in the US has long been truly miserable, but the additional $600-a-week federal top-up on benefits meant that many workers were better off out of work than in work, much to the dismay of their employers, who prefer to force their workers to accept miserable wages out of desperation. The $1,200 cheques that were sent out to all were similarly calculated to drown out the massive corporate hand-outs.

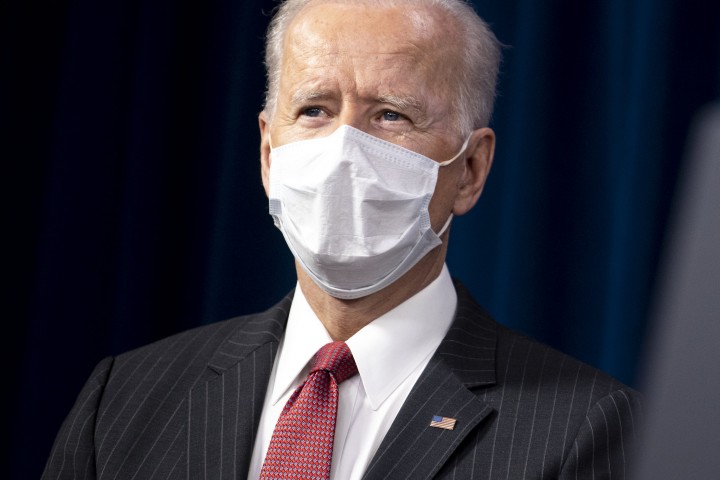

A question at Davos was how to “Build Back Better”, as Joe Biden’s presidential campaign put it. In other words: using the state to cushion the effects of the crisis and avoid revolution / Image: US Sec Defence, Flickr

A question at Davos was how to “Build Back Better”, as Joe Biden’s presidential campaign put it. In other words: using the state to cushion the effects of the crisis and avoid revolution / Image: US Sec Defence, Flickr

At the time, the bailout received support from unexpected quarters, like Senator Pat Toomey, who opposed the 2009 stimulus, and now wants a flat tax and wants to abolish the IRS (US federal tax collector). “This should be considered a very freakish Black Swan event, not anything that would be revisited under ordinary circumstances,” he argued.

The question that engaged Davos this year was not so much how to deal with the immediate situation, but how to continue along the same lines after the pandemic. “Build Back Better”, as Joe Biden’s presidential campaign put it.

Steve Bannon, in his own way an astute political observer, in the spring of last year pointed out that the coronavirus had changed things:

“‘The era of Robert Taft, limited-government conservatism?’ said Steve Bannon, President Trump’s onetime political guru, referring to the Ohio senator who fought the expansion of government programs and federal borrowing. ‘It’s not relevant. It’s just not relevant.’” (Coronavirus Means the Era of Big Government Is…Back)

The same kind of attitude was reflected at Davos. We have, for example, Darren Walker, President of the Ford Foundation, which made a name for itself by promoting precisely the ideology of Milton Friedman. He said that the World Economic Forum participants are the world’s greatest capitalists, by which he means supporters of capitalism. He said he was a capitalist because he believes in capitalism, but: “If capitalism is to be sustained, we must put a nail in the ideology propagated by Milton Friedman.”

Martin Wolf, chief economics commentator at the Financial Times, wrote something very similar when it comes to Biden:

“But the needed shift can still occur, provided the Biden administration proves rather quickly that competent government by people who believe in it can deliver. It must show Ronald Reagan’s famous statement that ‘the nine most terrifying words in the English language are: I’m from the government, and I’m here to help’ is wrong. Trust in sound and decent democratic governance is not freedom’s enemy, but among its most important guarantees.”

It is not difficult to see where this newfound attentiveness to the plight of the poor comes from. During the Davos Forum, James Quincey, the CEO of Coca Cola, noted that business leaders must help shape an economy that “works for everybody.” The President of Paypal, Dan Schulman, asked:

“How can we expect somebody to embrace democracy when they don’t think the system is working for them? … We as businesses do have an obligation to step up, to work with the public sector, to work with all the communities that we serve.”

What he means is: how can the bourgeois expect the masses to avoid revolution when the present economic system just provides misery for them?

Russian President Vladimir Putin, in his speech to the forum, warned of parallels between the current era and the early 1930s, specifically about inequality, which, he said, has fueled both right- and left-wing radicalism, and an increase in extremist movements. Putin himself is quite aware of the difficulties facing governments, after his own dramatic fall in popularity, an increasing need to rely on fraud and police measures to stay in power.

For some time people like Warren Buffet, one of the richest men in the world, have argued in favour of taxes on the rich. In 2017 he expressed scepticism towards Trump’s corporation tax cuts. In 2018 he expressed similar views in an issue of the Time that was guest-edited by Bill Gates:

“The market system, however, has also left many people hopelessly behind, particularly as it has become ever more specialized. These devastating side effects can be ameliorated: a rich family takes care of all its children, not just those with talents valued by the marketplace.”

A very similar sentiment was echoed by Martin Wolf recently:

“Governments have to spend. But, over time, they must shift their focus from rescue to sustainable growth. If, ultimately, taxes have to rise, they must fall on the winners. This is a political necessity. It is also right.” (The threat of long economic Covid looms)

It is precisely the rising discontent in society that is fueling this rethink among world leaders. As Martin Wolf puts it, it is “a political necessity”. The dramatic decline of faith in “democracy”, i.e. capitalism, is deeply worrying to the bourgeois and their representatives in the media and politics. What the “Great Reset” is about is therefore first and foremost to restore faith in Capitalism.

Wishful thinking

What we need, the UN general secretary said, is a “new social contract”:

“[T]o enable people to live in dignity. A new social contract between governments, peoples, civil society, businesses and more, integrating employment, sustainable development, social protection, and based on equal rights and opportunities for all.”

The problem for them is that this is all wishful thinking. Certainly, some concessions are being made at the moment. Biden is making a lot of noise about doubling the federal minimum wage in the US to $15 per hour, but only by 2026, and he might find himself with the convenient excuse that Congress will block the proposal. Similarly, the Conservative Party in the UK has picked up a number of policies from Corbyn’s Labour, for example on economic stimulus.

Yet, at the same time as they are doing this, there are mass layoffs being prepared in hospitality, transport and manufacturing, and major companies are launching major assaults on workers’ terms and conditions. Rather than investing in machinery to make themselves competitive, these companies are competing by worsening terms and conditions, attempting to set workers against workers. Workers will be asking themselves what kind of “new social contract” it is when workers are being forced to accept 20 percent or more pay cuts.

The “Great Reset” also involves a discussion of various kinds of green investment strategies, and this has become a big trend. UK Prime Minister Johnson has announced a £12 billion “Green Industrial Revolution” (a name borrowed from Labour’s 2019 manifesto). The Biden administration is reportedly looking to invest $2,000 billion in renewable energy. Green Investment is also a key part of the EU’s €1,800 billion recovery fund.

They all adopt similar language, “rebuilding”, “transition” and so on, but of course this is a transition that will end up exactly where we started, in the midst of a capitalist crisis. For even $2,000 billion will not solve the crisis, either of the economy or the environment.

Reformist politicians are now falling over themselves trying to support these schemes. The attitude of Sanders and other left-wing Democrats towards Biden is instructive, as they feel that they have ‘won the argument’. However, they are quite wrong. The reality is that the ruling class can feel the pressure from below. They can feel the first tremors that are felt before the eruption of a volcano. The truth is that the ruling class are desperate to stabilise the political situation, and the only way to do that is to give some concessions.

Ironically, the British Conservatives used to accuse Labour of believing in “the magic money tree”. Now they all believe in it. In practice, the central bankers and governments of the imperialist powers have become followers of Modern Monetary Theory (MMT). That is, they are funding government spending through the creation (printing) of new money, and they have no plans to balance the books. That’s very similar to what proponents of MMT think, as they believe it is unnecessary to balance the budget as the state can merely create more money.

The chair of one of the federal reserve banks in the US was asked by Bloomberg: “Have you all become followers of Modern Monetary Theory?” He said ‘no’, central bankers think this should only be done in times of crisis, or, as Republican Pat Toomey put it, it is only for a “black swan event”.

The point is, however, that they’ve been printing money through Quantitative Easing for 12 years now. The exceptional has become the new normal. The question is how long can they keep this up. Janet Yellen, the new US Secretary of the Treasury, used to be an advocate of balanced books when she worked for the Clinton administration. At that time state debt was the equivalent of around 50 percent of GDP. Now she says that a debt equivalent to 100 percent of GDP – the present level – is sustainable, although she doesn’t think 200 percent is. The truth is that she doesn’t really know. That this can’t go on forever is abundantly clear. With a budget deficit equivalent to 15 percent of GDP, the level of 200 percent would be reached in less than ten years without serious cuts.

Unsustainable

The reality is of course, that no one knows the limit. There isn’t an absolute limit. The limits would be different for different countries, as they are dependent on their relative strength on a world scale and, crucially, on finance capital. That means that the US and Europe can manage longer than Pakistan or Brazil. China can manage longer than Thailand, etc. The truth is that relatively few countries can get away with such a policy for long. For most of the world’s governments, this is not an option.

The situation can only be sustained whilst inflation and interest rates remain historically low. If inflation were to take off, the central banks would be forced to increase the cost of borrowing, which would very quickly make these massive debts unsustainable. As a recent IMF study notes:

“History teaches us that many crises have occurred after years of low differentials, and that market expectations can turn quickly and abruptly, shutting countries out of financial markets in a matter of a few months.”

That is, all will appear to be fine and sustainable, until it is not. It should be remembered that the Greek debt crisis didn’t occur in 2008 but a couple of years into the crisis. As long as central banks are buying up government debt, the risk is less, but that just transfers the problems from the government to the central bank. Governments, central bankers and commentators are all hoping that they will be able to manage the situation and pull back before disaster strikes, but the history of capitalism shows that this is pure wishful thinking.

The Tories lambasted Labour’s ‘magic money tree’, but now they’re spending at unprecedented levels / Image: Number 10, Flickr

The Tories lambasted Labour’s ‘magic money tree’, but now they’re spending at unprecedented levels / Image: Number 10, Flickr

Already some commentators are sounding the alarm, including Larry Summers, Obama’s former treasury secretary, who for years have been warning about secular stagnation. Now he’s worried that the latest stimulus will create “inflationary pressures of a kind we have not seen in a generation”. His concerns are echoed by Oliver Blanchard, former IMF chief economist, who warns that Biden’s $1.9tn programme “could overheat the economy so badly as to be counterproductive”. In an unplanned economy like capitalism, it is impossible to tell in advance how much would be too much.

There is another aspect to this. The more concessions are given, particularly after a struggle, the more the working class will see the benefit of fighting for demands. It’s interesting to see that in the aforementioned trust barometer, 50 percent of those employed say they are “more likely now than a year ago to voice my objections to management or engage in workplace protest”. This, in spite of the fear of job losses that the same poll revealed.

The ruling class are now facing a most difficult choice. If they go on the offensive and attempt to make the workers pay for the crisis, the already difficult political situation can very rapidly deteriorate. On the other hand, if they attempt to concede, they will risk encouraging workers to demand more, and even temporary programmes can become very difficult to withdraw. “Nothing is so permanent as a temporary government program,” as Milton Friedman put it. It is enough to look at the discussions over the US unemployment benefits to see what he meant.

Furthermore, no government really has the money for these programmes. Each government has to borrow, and it can only borrow as long as the central bank is printing money to fund it. This is a disaster waiting to happen. The ‘Great Reset’ is an attempt to restore the political equilibrium at the expense of the economic equilibrium.

In the end, government expenditure cannot resolve the crisis, but merely postpone it. The capitalist economy is based on profitability. If the big corporations cannot sell the products that their factories are able to produce, they simply won’t build new factories. If the hotel chains have lots of empty rooms, they won’t build more hotels, etc. Massive investments in energy will not solve this overcapacity.

The huge debts that have been accumulated are a massive drag on the world economy and producing ever more debt will only postpone the reckoning, as they have done for decades already. The present situation is a glaring example of the failures of the capitalist system and its ‘free market’.

For a while, the “Great Reset” and similar ideas will occupy the minds of the ruling class. They need to buy themselves some time to try and stabilise the political situation. However, their measures will be insufficient to stem the level of anger and resentment that they have provoked, and by making concessions they will show the mass of working that it pays to fight. When the limits of this policy are reached, they will then be forced to turn back to austerity and cuts. Thus proving, again, that there is no way out for workers under capitalism.

Ironically, the attempt to use the state to keep the economy going is evidence of precisely the failure of capitalism. Far from modern capitalism being hemmed in by the state, as the monetarists imagine, it is rather more dependent on the state than ever. As Ted Grant pointed out, this statisation shows that the productive forces have outgrown the capitalist system, and only by eliminating the profit motive can humanity progress.

*** This article has been archived for your research. The original version from In Defence of Marxism can be found here ***