How Fox uses the World Cup and Masked Singer to keep Fox News on air

Around 2010, Angelo Carusone was watching Glee when an urgent message ticked across the bottom of his screen. It alerted him and other Long Island viewers that they might soon lose access to the network showing Glee – Fox – and several other Fox channels, and urged them to call their cable company, Cablevision (now Optimum), to demand the company keep Fox.

The issue at hand was a dispute over cable carriage fees: a little-known – and, for Fox, highly lucrative – revenue stream paid by cable companies to television networks in exchange for the rights to broadcast their content. Every three years, cable providers and TV networks agree on a flat, monthly fee that is passed on to the subscriber – and, since cable subscribers generally do not get to choose what channels are part of their cable bundle, that fee is paid regardless of whether or not the subscriber watches a given network.

When the ominous message crawled across the bottom of Glee, Fox was demanding a huge fee increase from Cablevision. Fox executives were deploying a strong-arm strategy they had been honing for years: getting their audience to fight the battle for the company. “I realized that it was actually a big fight over Fox News,” says Carusone, now president of the progressive media watchdog Media Matters, “and they were leveraging Glee at the time as their big tool to get people to make these calls.”

These carriage fees are now so valuable to Fox that reporting from Media Matters has found that Fox would still have a profit margin of more than 35% even if it sold no advertising. Last year, Lachlan Murdoch, CEO of the Fox Corporation, boasted that Fox was becoming less reliant on advertising thanks to its increasing carriage fees. Today every cable subscriber, regardless of viewing habits, pays about $2 a month to Fox News – a fee bested only by ESPN, and substantially higher than those paid to CNN and MSNBC ($1.06 and $0.36, respectively).

Now, in the 2023 and 2024 fiscal years, Fox Corporation is renegotiating its carriage contracts with three of the country’s biggest cable providers: Cox, Xfinity and Spectrum. Recent reporting from Vanity Fair suggests that Fox News is looking to raise its rates to a whopping $3 per head – which would allow the news network to extract over $1.8bn annually from carriage fees alone. And if the past is any indication, Fox is likely to leverage its sports and entertainment programming – including the World Cup, NFL, Bob’s Burgers and the Masked Singer – in this battle for higher carriage fees for Fox News.

In the early days of cable television, revenue streams were straightforward: commercial television networks made money from ads, and cable companies made money by moving earth, laying cables and giving customers access for a monthly fee. In those days, if money did change hands between the TV networks and cable companies, it went the other way, with some networks paying cable companies a nominal fee to carry their channels. But in 1983, the cable industry changed for ever. “ESPN inverted that relationship,” says Dr Aaron Heresco, associate professor of communication at California Lutheran University. The round-the-clock sports network started charging cable companies $0.10 per subscriber to broadcast its content. “That opened the floodgates,” Heresco says, and soon other networks were demanding small carriage fees from cable companies. These fees increased rapidly, with the charges passed on to customers. “You can pretty much accurately track the rise of cable bills with the rise of [these] fees,” says Heresco.

By the time Fox News launched in 1996, broadcasters paying cable companies for carriage had become highly unusual. But that’s exactly what Rupert Murdoch did, sometimes paying an unheard of $13 per subscriber to cable companies so that they would carry Fox News. Per the cable historian Dr Patrick Parsons, one contemporary industry executive declared: “It scares the [heck] out of people that Murdoch’s willing to spend hundreds of millions to establish a beachhead.”

Thanks to Murdoch’s deep pockets, Fox News was available in over 17m households from the moment it launched. People watched, advertising boomed, and soon Fox stopped paying the cable companies and demanding fees from them: by 2005, Fox News secured the then high rate of $0.25 per subscriber each month; by 2007, the figure had tripled.

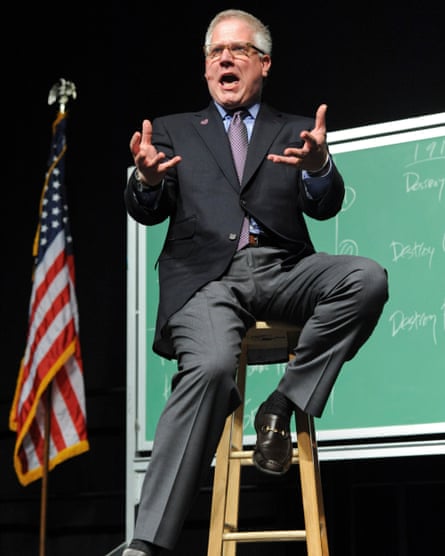

Fox News continued to demand higher carriage fees after 2011, when an ad boycott contributed to the ouster of the news network’s leading personality at the time, Glenn Beck. Beck, whose show had launched one day before Barack Obama took office in 2009, frequently called Democratic politicians vampires and Marxists and compared them to Nazis. Angelo Carusone, then a second-year law student, thought that if Beck’s advertisers knew what their money was supporting, they would be appalled. He began to seeing an ad boycott as a way to help reconnect Fox to “market realities”, Carusone says.

Carusone started watching Beck’s program religiously, tweeting what he saw and tagging advertisers. After Beck accused Obama of being “a racist”, organizations including Color of Change launched large campaigns urging advertisers to drop Beck’s show. Advertisers fled en masse, and Beck left Fox shortly thereafter.

After Beck’s departure, Fox further insulated itself from the whims of the marketplace and public pressure, with negotiations in 2015 slated to earn the company a record-breaking $1.50 per subscriber. In years since the rate has only increased, despite millions of Americans cutting the cord on their cable subscriptions altogether.

So why have cable companies put up with Fox’s repeated rate hikes? Many have told the FCC that Fox employs bad faith negotiating tactics. These include threatening and enacting blackouts and directly telling consumers to switch providers.

In 2015, during a weeks-long dispute and Fox News blackout on the satellite TV provider Dish, Fox ran an ad accusing Dish of censorship and telling viewers to switch providers immediately. In 2020, while negotiating with the internet-based distributor Roku, multiple Fox News hosts asked a similar conspiracy-minded question on Twitter. “Why is @Roku threatening to take away the Fox News app? We don’t know either! Tell Roku hands off your device, and to put you ahead of their business interests,” tweeted Jeanine Pirro and Sean Hannity.

“The same way that Fox would leverage that audience for political outcomes,” says Carusone, “they were able to do that just as effectively when they leverage them for these consumer fights.”

As a second lever of power, Fox Corporation – which owns Fox News, Fox Sports and others – has often tethered several of Fox’s myriad holdings into single negotiations, effectively allowing it to hold hostage popular sporting events if cable providers do not pay the requested fee for Fox News or other Fox entities.

In 2019, after Dish and Fox failed to come to an agreement, many Dish subscribers saw Fox channels go dark just before a new season of Thursday Night Football.

The 2020 dispute with Roku took place just days before the Super Bowl – for which Fox Sports was to be the only Roku app where viewers could watch the game in 4K resolution.

Last year, while negotiating with the cable company Optimum – whose customers live primarily in the New York metropolitan area – Fox alerted viewers that they might lose access to Fox Sports just as the Yankees were entering the playoffs. Also last year, while Fox Corporation was negotiating for higher fees for some of its channels from the cable provider DirecTV, Fox threatened to black out much of its sports programming one day before it was scheduled to broadcast the US-Netherlands World Cup match. (This year, a former chief executive at Fox International Channels was convicted of wire fraud and money laundering after a justice department investigation alleged that Fox secured the World Cup broadcast rights with the help of inside bidding information; Fox Corporation, which is separate from Fox International Channels, denies any wrongdoing.)

Leaning on its huge variety of sports and entertainment programming alongside the zealousness of the Fox News audience, Fox has made itself a formidable opponent when negotiating fees – fees that are now significantly higher than cable companies pay to most other networks, and which may continue to climb.

But with Fox Corporation renegotiating 70% of its contracts in the 2023 and 2024 fiscal years, there are signs that the multibillion-dollar media empire may be losing some of its bargaining power. Critics of Fox News have been increasingly vocal about their opposition to Fox’s strong-arm tactics: in 2021, the NAACP sent a scathing letter to the NFL commissioner, Roger Goodell, telling the league to stop letting Fox use the NFL as a bargaining chip in its carriage fee negotiations for Fox News. “The NFL’s programming should not be used as a bargaining tool for Rupert Murdoch to help fund Fox News’ hatred, bigotry, lies and racism,” the NAACP president and CEO, Derrick Johnson, wrote.

In recent years, it appears that some Fox News negotiations are happening separately from Fox Sports negotiations. Carusone suggests it may be due to the Covid pandemic’s disruption of live sports and corresponding changes in contract terms.

Still, while the number of cable subscribers plummets, ever-increasing carriage fees are helping networks like Fox News stay afloat and buffer themselves from public accountability. Heresco says that arrangement always puts customers on the losing end. “I’m generally a pretty optimistic person,” he says, “[but] I don’t think these opaque, black-box, long-term, multibillion-dollar negotiations in which the audience is enlisted and weaponized by one company against another company – I don’t think there is any scenario in which that actually benefits democracy, or citizens, or education, or accurate information.”

This article has been archived for your research. The original version from The Guardian can be found here.