Financial Markets Realise – Pfizer May Go Bankrupt.

“Pfizer’s Greed and Recklessness Will Catch Up with Them. That Happened to Purdue Pharma,” according to Igor Chudov, who believes that the stock market may be waking up to the possibility that Pfizer may go bankrupt due to the upcoming Covid vaccine claims.

According to Chudov, there are notable similarities in the corporate practices of Pfizer and Purdue Pharma, a pharmaceutical company that unethically and aggressively promoted harmful products. Purdue Pharma eventually declared bankruptcy due to the greed and unethical conduct of its leaders, as their legal safeguards diminished. It is possible that Pfizer could face a similar fate.

Igor Chudov explains why he has come to this conclusion in the following article.

Pfizer May Go Bankrupt, Financial Markets Realize – by Igor Chudov,

SUMMARY: The stock market may be waking up to the possibility that Pfizer may go bankrupt due to the upcoming Covid vaccine claims. Many parallels can be drawn between the corporate behaviors of Pfizer and Purdue Pharma, another pharmaceutical concern that dishonestly and aggressively marketed harmful products. Purdue Pharma went bankrupt due to the greed and depravity of its leaders, as their “legal protections” evaporated. The same may happen to Pfizer.

Old, experienced vaccine companies like GSK refused to participate in “Covid vaccines” – and we now see why they made the right choice.

Take a look at this chart: Pfizer’s stock (PFE) is valued at 25% less than it was five years ago, despite the billions of dollars it received from the sales of COVID vaccines, and the stock market and the pharmaceuticals index having gone up:

At first sight, Pfizer, a worldwide pharmaceutical juggernaut, should not be worth less than before the pandemic. Pfizer’s COVID vaccine made it billions and should have added value to the company, even if future sales of COVID-19-specific products cannot be assured. And yet, PFE has inexorably fallen since last November and is worth 25% less than five years ago, defying the general upside tendencies seen for other pharmaceuticals and the stock market.

Since November of 2022, Pfizer has deviated from the trend of the pharmaceuticals index, underperforming by 35%.

This can only be explained by the capital markets seeing something uniquely troublesome for Pfizer. This post will explore what it may be.

I am far from the first person suggesting that Pfizer, which aggressively marketed its COVID vaccines and underwrote a worldwide influence operation to mandate its product, may face ruinous liabilities.

Ed Dowd, a former asset manager, was one of the first people to realize that. He explained that legal protection granted to Pfizer by the PREP act will cease to protect it if significant fraud on the part of Pfizer is discovered.

Purdue Pharma as a Blueprint to the Future of Pfizer

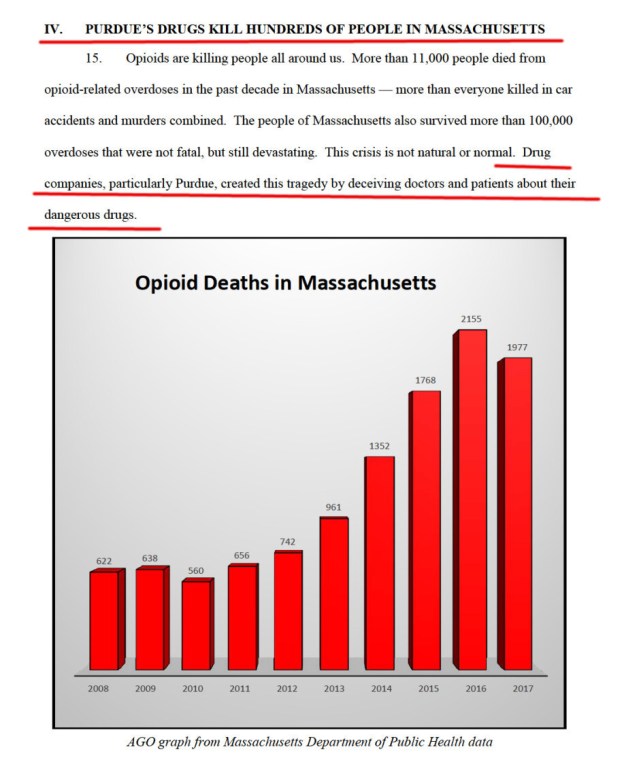

Purdue Pharma was a company making opioid-based pain relief medications. They were very addictive. Purdue was owned by the “Sackler family,” with the entire company leadership obsessed with maximizing sales of opioids and minimizing ethical concerns.

The story of Purdue Pharma, its relentless push towards higher doses of opioids given to patients to get them addicted, is much longer than the story of the Covid vaccines. This post is not the best place for a comprehensive history. The best quick introduction to the malfeasance of the Sackler family that owned Purdue Pharma is to read the PDF of the Massachusetts legal complaint.

The complaint reads like a detective story, full of sordid details about malfeasance in Purdue Pharma and the deaths that it caused.

Interestingly, the above page could be rewritten, word-to-word, to cover the COVID vaccines, which are technically not addictive but require endless repeat injections, do not prevent COVID-19, and cause excess deaths!

The Sacklers and Purdue Pharma used the same playbook as Pfizer did by buying off the corrupt press to place favorable publications. Take a look at just one example: a paid article from the New York Times:

As Massachusetts legal complaint explains, Purdue Pharma was paying the New York Times for advertising:

Purdue Pharma and Pfizer have something in common: unethical, greedy, and reckless management, exemplified by the Sackler family and Albert Bourla, respectively.

Our friend Geert Vanden Bossche, a vaccine expert, details the reckless corporate behavior of Pfizer regarding COVID vaccines here: Some vaccine companies renamed their Quality Control (QC) department into Quality ‘Compromise’ department…...

Voice for Science and Solidarity by Geert Vanden Bossche

Let us compare Pfizer, an aggressive entrant into the vaccine business, to GSK, an established and more careful player. GSK refused to play the COVID vaccine game. They realized that nothing good could come out in the long run. GSK declined to expose themselves to the potential liability of endangering millions with a vaccine that was extremely unlikely even to work.

The maternal RSV vaccine story further highlights how reckless Pfizer is.

The NIH gave the blueprint for the RSV vaccine to both Pfizer and GSK. Both companies tested essentially the same product. Clinical trials revealed that giving the RSV vaccine to pregnant women increased premature births and infant mortality.

GSK, the established and conservative vaccine company, wisely heeded the alarm signal and abandoned the maternal RSV vaccine development. Instead of honestly terminating the program, Pfizer purposely selected small vaccine and placebo groups to make the premature birth signal statistically insignificant and lobbied the corrupt FDA to approve its vaccine.

Pfizer’s RSV Vaccine Math: Kill 4,000 Newborns to Save 300 from RSV

That is nothing but greed and recklessness!

If so, the following are similarities between Pfizer and Purdue Pharma:

- Reckless disregard for the dangers to recipients of their products. Pfizer abandoned any semblance of care for Covid vaccine safety. Pfizer tested their recent vaccines on several mice only – just one example.

- Corporate greed is exemplified by risky decisions to chase billions in immediate profits at the risk of bankruptcy in the long run.

- Buying off the press and regulators to corruptly obtain support for their products.

- Hiding deaths and adverse effects from the public.

Purdue Pharma was able to play its game for years. Finally, the deaths were too many, and the lawsuits took it down.

If the stock price of Pfizer is any guide, the capital markets now see that the same may eventually happen to it.

Hopefully, the people who suffered various ills from COVID vaccines would be entitled to compensation.

Pfizer may also be the perfect player to throw under the bus to save other Covid pandemic players.

Pfizer, however, does not have enough money to compensate every victim fairly.

Are Google and Facebook also Liable?

A year ago, I wrote a post explaining that Google and Facebook can also be liable to Covid vaccine victims because they intentionally conspired to hide the dangers of COVID vaccines from the public.

These internet giants, which profited mightily from the pandemic, are bigger fish than Pfizer: each victim could receive up to $15,000 in value if Google and Facebook are found liable.

Purdue Pharma owners thought, for years, that they could hide wrongdoing and avoid liability due to corporate shields. However, when malfeasance was discovered and the victims could no longer be hidden, legal theories caught up with them. The claims bankrupted that company and cost their owners, the Sacklers, billions.

Hopefully, the same will eventually happen to Pfizer, Google, and Facebook, the three companies most instrumental in what happened during the last three years.

I realize it is a long shot, but I have hope for a measure of eventual justice. My hope is supported by the realization that monetary compensation may incentivize broad groups of people to ask for legal redress.

The stock market, it seems, sees the same thing now, with the Pfizer stock declining relentlessly.

Do you think that one day, Pfizer will go bankrupt due to Covid claims?

Source – Igor Chudov,