The Macroeconomic Consequences of Lockdowns and the Aftermath

Guest Post by David Stockman

During the past three years, Washington has made three catastrophic errors.

These include:

- The draconian one-size-fits-all Lockdowns in response to the Covid;

- The insane $11 trillion bacchanalia of monetary and fiscal stimulus payment designed to counter the supply-side shutdowns caused by the Virus Patrol;

- The mindless Sanctions War on Russia, which has caused global commodity markets to erupt skyward.

The resulting economic and financial dislocations, both global and domestic, are unprecedented and could not have come in a worst context. Prolonged fiscal and monetary excesses prior to February 2020 were already destined to generate an era of reckoning, even before Washington jumped the shark after the Covid panic was ignited by Donald Trump in March 2020.

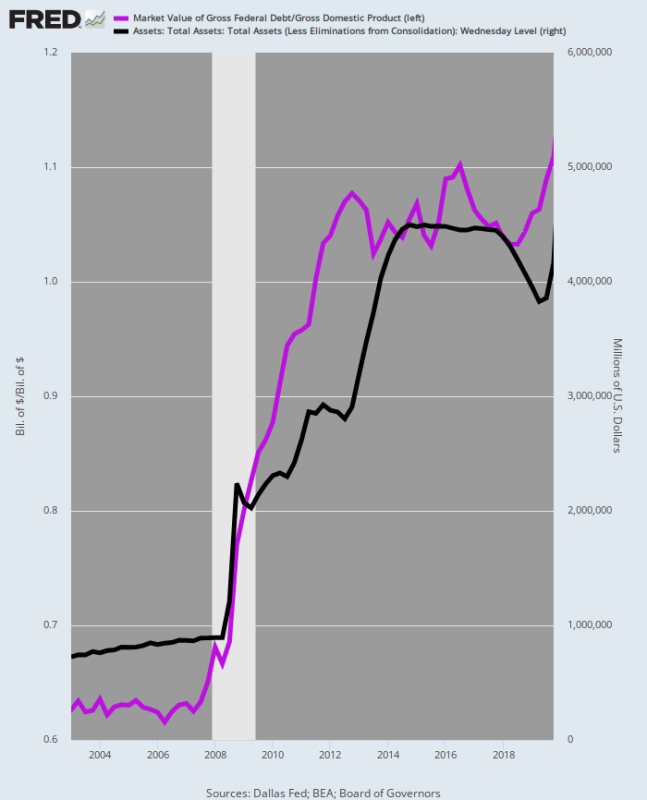

Consider the course of fiscal and monetary policy over 2003-2019. During that 17-year period, the public debt share of GDP soared from an already high 62% to 111%, and the Fed’s balance sheet exploded under the bailouts of 2008-2009 and QE thereafter from $725 billion to $4.2 trillion. The latter embodied a growth rate of 11.0% per annum over the period, nearly three times the 4.0% growth rate of nominal GDP.

In a word, Washington policy makers had been on a reckless lark for the better part of two decades. It was only a matter of time before an unavoidable policy reversal toward restraint would bring the hothouse prosperity of both Wall Street and main street crashing down.

Public Debt As % of GDP and Fed Balance Sheet, 2003-2019

The history books will surely record, therefore, that it was Trump who foolishly ignited the above depicted ticking financial timebomb. Based on the facts known now and the evidence available then, the prolonged Lockdowns ordered by Trump on March 16, 2020 were one of the most capriciously destructive acts of the state in modern history.

The reason is simple: The Covid was at best a super flu that did not remotely rise to a Black Plague style existential threat to American society, and therefore did not warrant any extraordinary “public health” intervention at all. America’s medical care system was more than equipped to handle the elevated case loads among the elderly and comorbid that actually occurred.

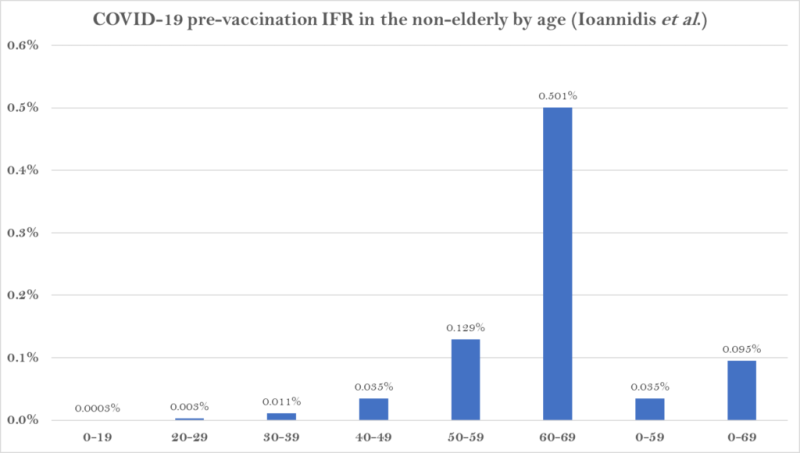

Indeed, the IFR (infection fatality rate) for the under 70-years population has turned out to be so low as to make the brutal economic shutdowns ordered by the Donald and his Fauci-led Virus Patrol tantamount to crimes against the American people.

A thorough-going study by Professor Ioannidis and colleagues across 31 national seroprevalence studies in the pre-vaccination era, for example, shows that the median infection fatality rate of COVID-19 was estimated to be just 0.035% for people aged 0-59 years and 0.095% for those aged 0-69 years. So we are talking about just four-to ten-hundredths of one percent of the infected populations succumbing to the disease.

A further breakdown by age group found that the average IFR was:

- 0.0003% at 0-19 years

- 0.003% at 20-29 years

- 0.011% at 30-39 years

- 0.035% at 40-49 years

- 0.129% at 50-59 years

- 0.501% at 60-69 years.

There is just no beating around the bush. The Lockdowns impacted the livelihoods and social life primarily of the working age and youth populations depicted below, but not in a million years should the heavy hand of the state been brought to bear on their ordinary freedoms to conduct economic and social life as they saw fit.

Nor does the Donald and Fauci’s Virus Patrol get off the hook on the grounds that these dispositive facts about the Covid were not fully known in early March 2020. But to the contrary, the results of a live fire case study involving the 3,711 passengers and crew members of the famously stricken and stranded cruise ship, the Diamond Princess, were fully known at the time, and they were more than enough to quash the Lockdown hysteria.

During late January and February the virus had spread rapidly among the large, close-quartered population of the cruise ship, causing nearly 20% of the population to test positive—about half of which were symptomatic. Moreover, the population skewed elderly as is normally the case on cruise ships, with 2,165 people or 58% over 60-years of age and 1,242 or 33% over 70-years.

So if there was a vulnerable population sample this was it: That is, a stranded population of the mostly elderly in the close quarters of a cruise ship.

But, alas, the known mortality count from the Diamond Princess as of March 13, 2020 was just nine, and ultimately 13, meaning that the overall population survival rate was 99.8%. Moreover, all of these nine deaths were among the 70 years and older population, making the survival rate for even among the most vulnerable sub-population 99.3%,.

And, of course, for the 2,469 persons under 70-years of age on this ship, the survival rate was, well, 100%.

That’s right. Donald Trump and his way-in-over-his-head son-in-law, Jared Kushner, knew or should have known that the survival rate of the under 70-years population on the Diamond Princess was 100%, and that there was no dire public emergency in any way, shape or form.

Under those conditions, anyone with a passing familiarity with the tenets of constitutional liberty and the requisites of free markets would have sent Dr. Fauci, Dr. Birx and the rest of the public health power-grabbers packing.

That the Donald and Jared did not do. Instead, they got led by the nose for month after month by Fauci’s awful crew because basically Trump and Kushner were power-seekers and egomaniacs, not Republicans and certainly not conservatives.

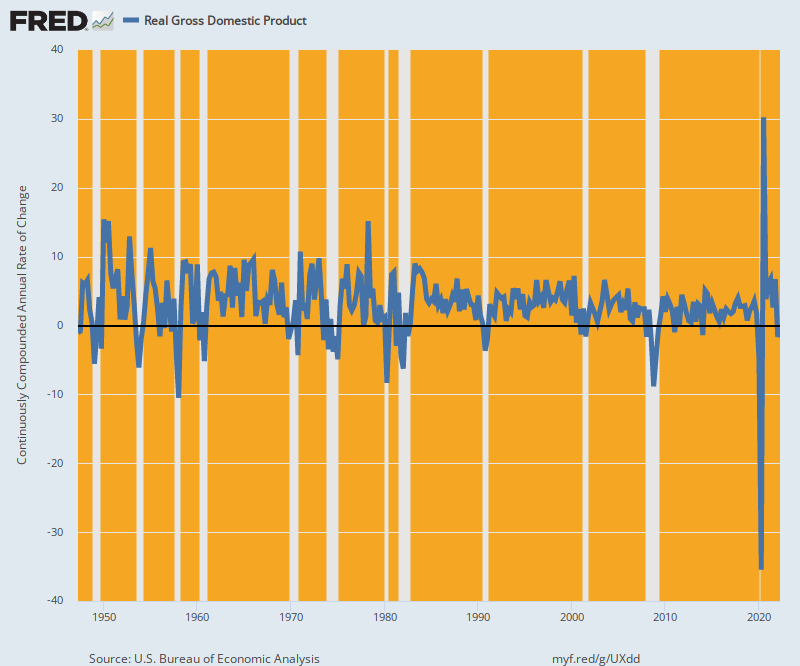

The resulting unnecessary economic wreckage is almost unspeakable. Here are four measures which show that the instant plunge in economic activity triggered by the Lockdowns was simply off-the-charts compared to any prior history.

During Q2 2020, for example, real GDP plunged by 35% at an annualized rate, leaving the declines during the prior 11 post-war recessions (gray columns) far in the dust.

Annualized Change In Real GDP, 1947 to 2022

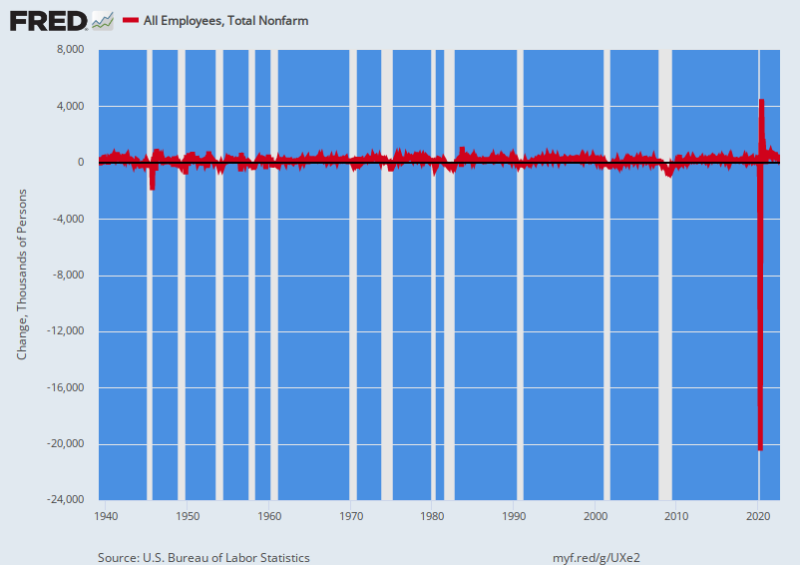

Likewise, the drop in Q2 employment was in a whole new zip code. During April 2020, the US economy shed 20.5 million payroll jobs—a figure that was 28X larger than the worst job loss of the Great Recession in February 2009 (-747,000).

Monthly Change In Nonfarm Payrolls, 1939-2022

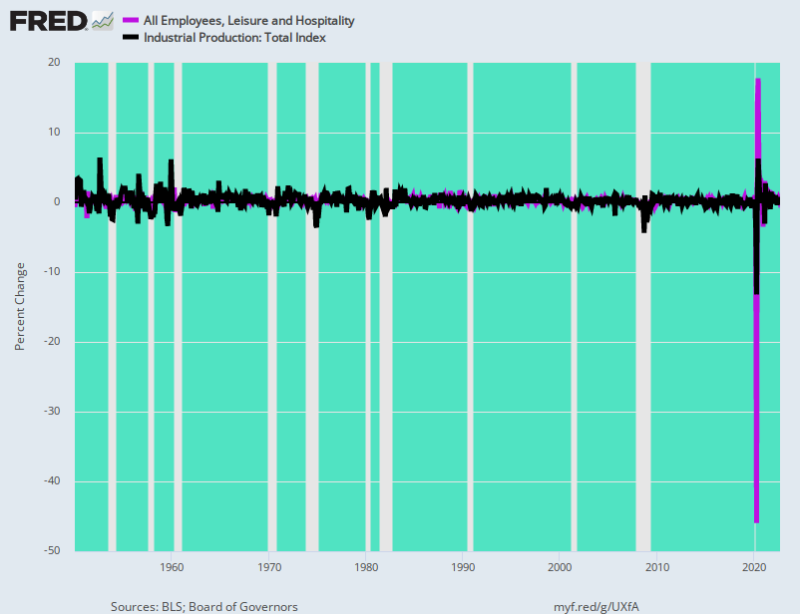

Even industrial production (black line), which was not nearly as heavily impacted as the Leisure & Hospitality (L&H) and other services industries, dropped by 13%, or nearly 4X more than during the worst month of the Great Recession.

At the same time, payrolls at ground zero of the Lockdowns— restaurants, bars, hotels and resorts (purple line)— plummeted by a staggering 46% during April 2020 or by 50X more than any prior monthly decline.

Monthly Change In Industrial Production and Leisure & Hospitality Payrolls, 1950-2022

To call the above a “supply-side shock” is hardly an adequate description. Donald Trump literally decimated the production side of the US economy because he did not have the gumption, knowledge and policy principles necessary to blow off Fauci’s statist attack on America’s market economy.

But what came thereafter was actually worse. The Donald did not care a wit about fiscal rectitude and the surging public debt that was already in place; and actually had demanded time and again even more egregious money-printing than the ship of fools in the Eccles Building were already foisting upon the American economy.

So he loudly clambered on board as the panicked politicians on Capitol Hill and the money-printers at the Fed opened the stimulus sluice gates like never before. The resulting disaster is now coming home to roost, with Joe Biden being the available fall guy, and rightfully so–given the compounding damage being wrought by his truly idiotic proxy war against Russia and the related Sanctions War attack on the global trading and payments system.

Still, at the end of the day the disaster now unfolding was ignited by the Donald from the combustible fiscal and monetary brew he inherited.

And his current dominance of the GOP tells you all you need to know about what lies ahead. The once-upon-a- time “conservative party” in the economic governance of America has become about as useless for the task as teats on a boar.

The Aftermath

Needless to say, the 35% annualized plunge in real GDP during Q2 2020 was not caused by “aggregate demand” suddenly petering out. In fact, there was nothing about this unprecedented collapse in economic activity that was remotely related to the prevailing Keynesian demand-driven models.

To the contrary, the Covid contraction was all about the supply side. The latter had been directly monkey-hammered not by reluctant consumers and spenders, but by the marauding Virus Patrol which was shutting down restaurants, bars, gyms, ball parks, movie theaters, malls and countless more via direct “command and control” orders of the state.

To be sure, when you lay off 20.5 million workers in a single-month (April 2020), for instance, that does cause household purchasing power to diminish. But it was also a case of Say’s Law getting its due. Diminished supply was curtailing its own demand.

Indeed, the derivative loss of “aggregate demand” in April 2020 and the months immediately thereafter was tracking the prior loss of production and income. Consequently, the Keynesian solution of replenishing the lost demand with government transfer payments, promised only to draw down existing inventories, pull in more imports from less supply-constrained economies abroad and eventually inflate the price of existing supplies–whether from inventories, domestic production or sources abroad.

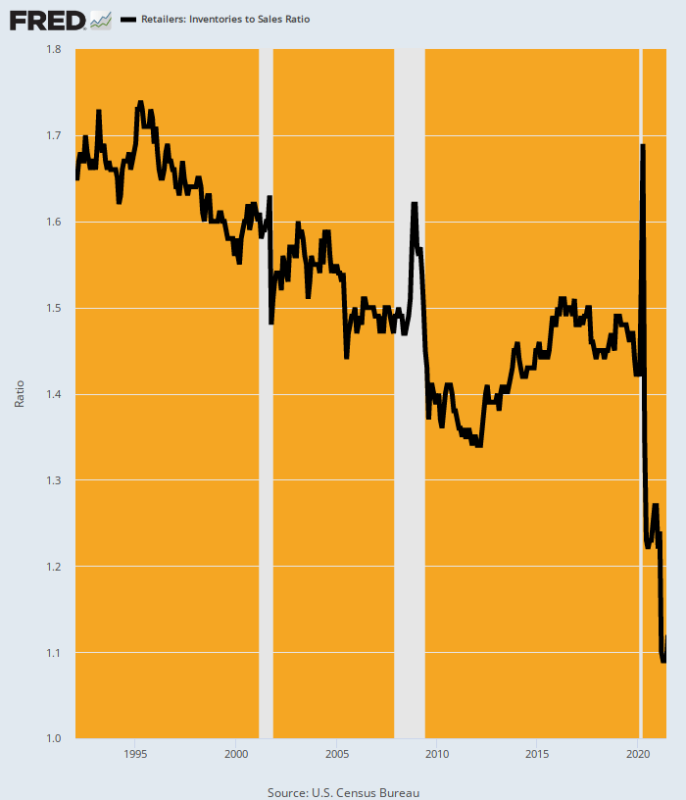

In fact, this is exactly what happened in a process of further drastic economic distortion compared to all prior history. In the case of retail inventories, stimmy-fueled “demand” literally sucked the inventory stocks dry. The ratio to sales plunged to an unheard of low of 1.09 months by May 2021.

Retail Inventory-To-Sales Ratio, 1992-2021

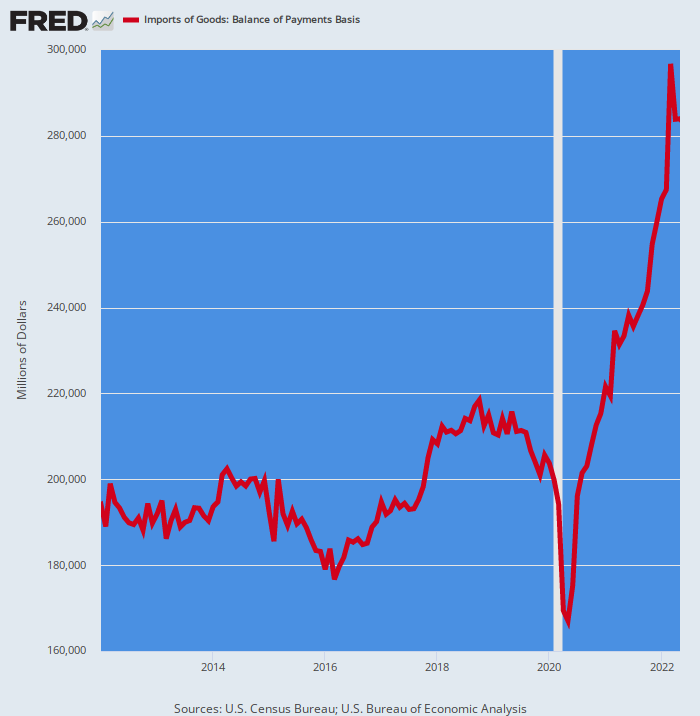

Likewise, import volumes erupted like never before. Between the pre-Covid level of $203 billion per month in January 2020 goods imports have soared by 46% to $297 billion per month. That’s a $1.1 trillion annual rate of gain!

China, South Korea, Vietnam and Mexico are undoubtedly grateful. But the only pump Washington’s massive stimmies primed was located mainly in foreign economies. Meanwhile, the US economy struggled all the way through this period because the shutdown orders and fears generated by the Virus Patrol drastically constricted the supply side of the US economy.

Keynesian demand had nothing to do with it!

US Monthly Imports Of Goods, 2012-2021

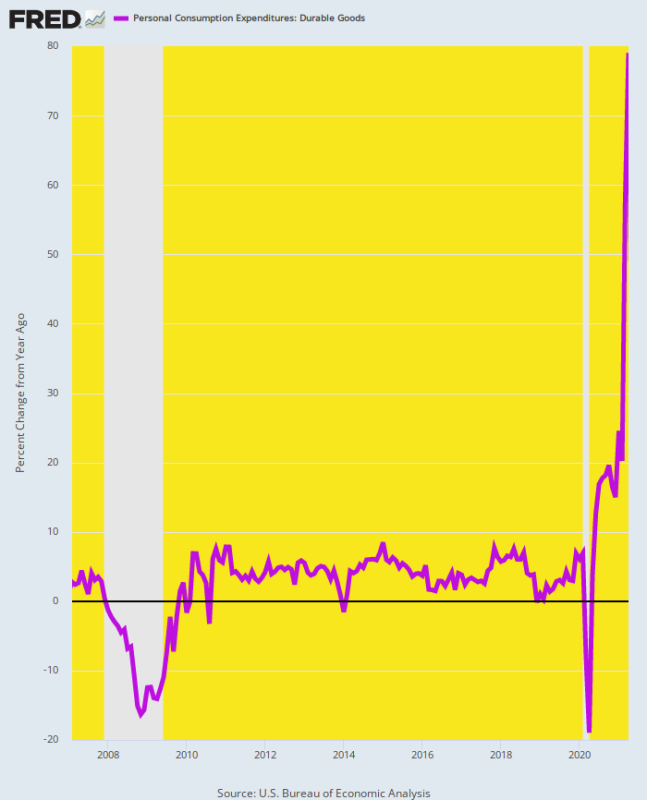

In fact, the startling eruption of demand for durable goods leaves no doubt about how wrongheaded the giant stimmies actually were. Since money could not be readily spent on the normal slate of services, households went bananas spending their restaurant money savings and their multiple rounds of stimmies on goods that could be delivered to the front door by Amazon.

By the time the stimmies peaked in April 2021, personal consumption expenditures for goods were up by a staggering 79% over prior year. The resulting aberration in the flow of economic activity is plain as day in the chart below.

Y/Y Change In Personal Consumption Expenditures For Durable Goods, 2007-2021

At length, foreign supply chains buckled under the weight of artificial demand for goods stimulated by Washington and European policy-makers—a dislocation that was then compounded when their unhinged Sanctions War against Russia caused petroleum, wheat and other commodity prices to soar, as well.

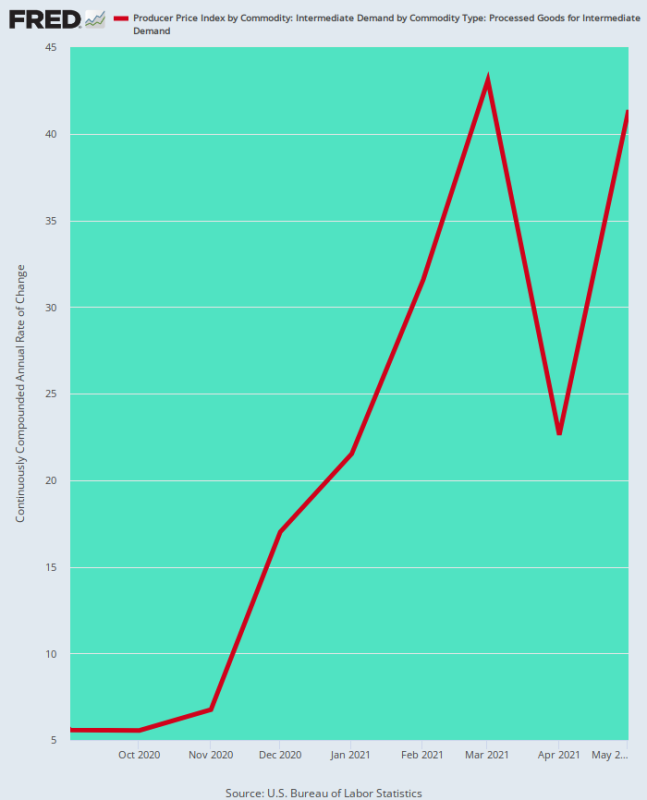

As best shown by the lead indicator of upstream PPI prices for intermediate processed goods, inflation was brewing in the supply pipeline as early as September 2020, when the annualized rate of change posted at 5.6%. By December 2020 that figure had risen to 17.0%, and then was off to the races: Wholesale prices for processed goods were rising at a 43% annualized rate by March 2021.

As it happened, the downstream CPI began to accelerate in March 2021, but by then the die was cast. Washington’s foolish attempt to massively stimulate “demand” in an economy that was being drastically curtailed on the supply side by its own public health orders and policies had already ignited the most powerful inflationary cycle in 40 years.

Of course, in March 2021, at the peak in the brown line below, Washington was still in full-on stimulus mode. Joe Biden’s $2 trillion American Rescue Act was injecting another round of fiscal stimulus, even as the Fed persevered in buying $120 billion per month of government and GSE debt.

Annualized Rate Of Change, PPI For Intermediate Processed Goods, September 2020 to May 2021

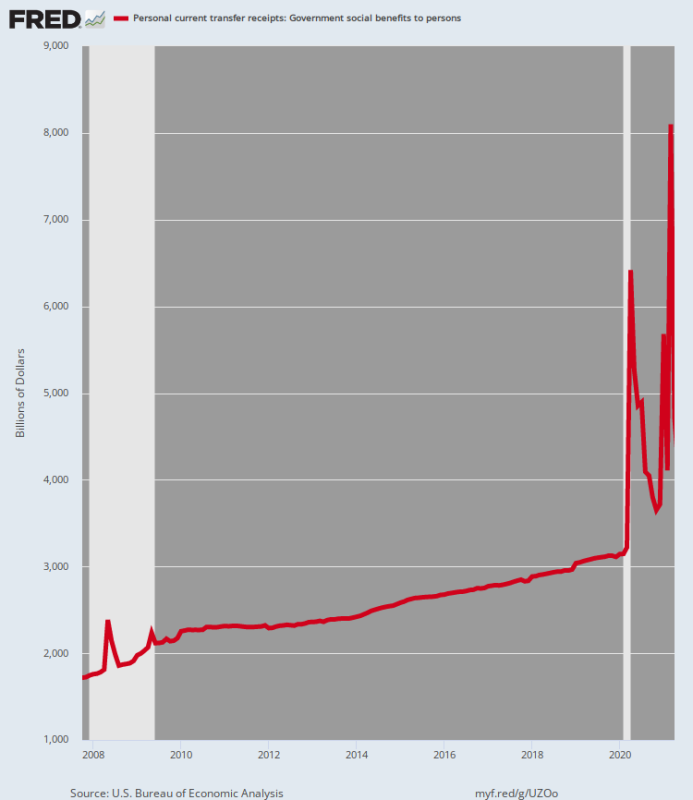

Here is the annualized rate of government transfer payments for the last two cycles—with the latter one, again, being off the charts by a country mile.

During the Great Recession cycle, the maximum increase in the government transfer payment rate was +$640 billion and 36% between December 2007 and May 2008 (i.e. the Bush tax rebate stimulus of that month was actually bigger than Obama’s shovel ready stimulus in February 2009).

By contrast, under the absolute frenzy of stimmies during the Covid cycle, government transfer payments increased from a run rate of $3.15 trillion per annum in February 2020 to $8.10 trillion by March 2021. That’s when the two Trump stimmies and the Biden add-on maxed out at $6 trillion in total spending.

The math of it is staggering. The annualized rate of government transfer payments rose by $4.9 trillion during that period, representing an out-of-this-world gain of 156% in just 13 months!

Is there any wonder that the American economy has been over-run with a “demand shock” of biblical proportion?

Annualized Rate Of Government Transfer Payments, November 2007 to March 2021

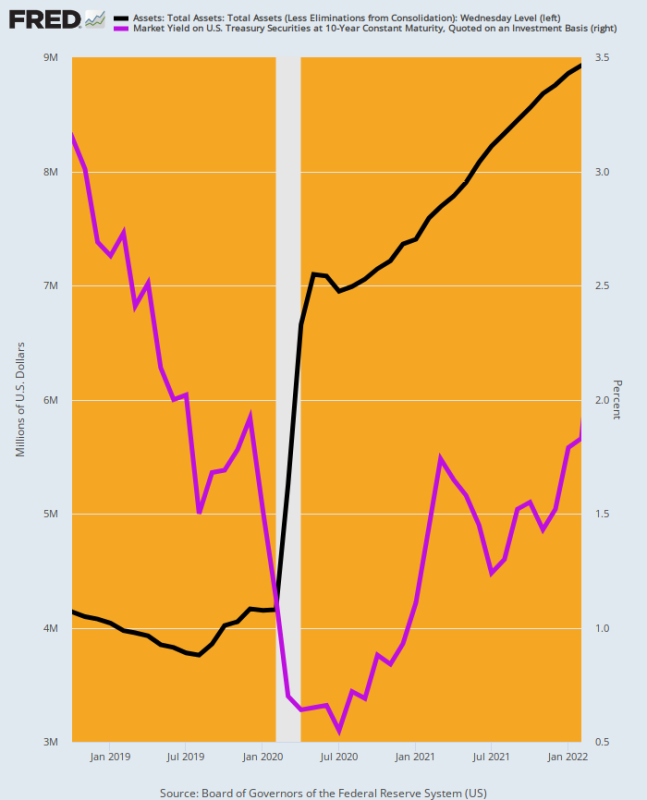

An eruption of government spending and borrowing of this staggering magnitude within a matter of months would have normally caused a giant squeeze in the bond pits, sending bond yields soaring skyward. But that didn’t happen: The benchmark yield on the 10-year UST (purple line) actually fell from an already low 3.15% in October 2018 to an absurd 0.55% in July 2020, and remained at just 1.83% thru February 2022.

There is no mystery as to why. During the same period, the Fed’s balance sheet (black line) erupted as never before, rising from $4.1 trillion to a peak of $8.9 trillion by February 2022. That is to say, the Eccles Building monetized a huge share of the stimmy spending, thereby drastically falsifying the entire market for government debt and all the private household and business debt that prices off from it.

Is it any wonder, therefore, that the Virus Patrol was able to run roughshod over the private economy?

Washington compensated one and all for the resulting harm and then some by unleashing a $6 trillion spending bacchanalia in less than 14 months, which was accomplished with barely a dissent from either party to the Washington duopoly because interest rates on government debt had plunged to an all-time low. In turn, that was enabled by the most reckless spurt of money printing and debt monetization in recorded history.

Meanwhile, the stock market and related risk assets rose by 60% on average and by two times, three times, and ten times in some of the hottest “momo” sectors during the same period. America was simply drunk on spending without production, borrowing without saving and money-printing without limit. It all amounted to a phantasmagoria of financial excess like had never before even been imagined, let alone attempted.

Fed Balance Sheet And Yield On 10-Year UST, October 2018 to February 2022

The real skunk on the woodpile, however, is that the rationalization for all of this fiscal and monetary excess —protecting households and businesses from the plunge of economic activity — was essentially bogus. The lost aggregate demand did not need to be replaced with stimulus and free stuff because there had been a prior and equal decline in aggregate production and income.

The only “stimulus” needed to restore the economy’s status quo ante was to send the Virus Patrol packing. That is to say, the Fed’s balance sheet could have stayed at $4 trillion (better yet it could have been returned to the previous path of QT-based shrinkage), even as the fiscal equation could have been pushed toward balance after decades of reckless borrowing.

To be sure, low-wage workers got hit the hardest because they worked in the services sectors slammed by the Virus Patrol, meaning there was an “equity” case for some kind of government help in these cases. But, alas, the help was already there in the form of the automatic shock absorbers that have been erected in the Welfare State over the last decades. We are referring to unemployment insurance, food stamps, ObamaCare, Medicaid and a medley of lesser means-tested programs.

The emphasis here is on means-tested. The so-called Safety Net was fully in place, would have covered 90% of the Covid-Lockdown hardship automatically and therefore required no fiscal bailout legislation at all, to say nothing of the $6 trillion of spending orgies that actually transpired.

The only thing missing was that fact that state unemployment programs generally exclude gig and part-time workers, the very modest segment of the labor force that got clobbered the hardest. But a year’s worth of support at $30,000 per worker (more than they make on average) for an estimated 5 million gig workers not covered by regular state UI programs would have cost $150 billion or just 2.5% of the tidal wave of Covid relief spending that actually occurred.

In any event, the US economy was a financial timebomb fixing to explode in February 2022 when Joe Biden decided to save “Novorossiya” (New Russia) from the Russians, who had intervened to protect their kinsman from the devastating attacks being leveled on the Donbas by the anti-Russian government planted in Kiev by Washington during the February 2014 coup.

The resulting Washington-inspired Sanction War on the largest commodity producer on planet earth was the tripwire for the calamity now underway.

Washington’s three great errors have turned the world upside-down. An economy freighted down with $92 trillion of public and private debt was, is and will remain an accident waiting to happen.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can’t do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC – PO Box 1520 Kulpsville, PA 19443] or Paypal

—————————————————–

To donate via Stripe, click here.

—————————————————–

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

This article has been archived for your research. The original version from The Burning Platform can be found here.