The reasonable case against CBDCs

MainFT’s Sid Venkataramakrishnan has a fascinating big read in today’s paper, looking at how central bank digital currencies (CBDCs) got swept up in the culture wars. Here’s an extract:

A few years ago, CBDCs were the domain of policy wonks. Today, they are a topic of growing political importance and, among fringe groups, creeping paranoia. Although the exact nature of CBDCs vary from country to country, their overarching nature is that of a digital version of physical cash — money issued by the central bank, unlike cryptocurrencies, which are created by private entities.

The article covers how CBDCs have got tied up in the fringe “Great Reset”/“the World Economic Forum is run by lizards” narrative, but also includes plenty of voices making more grounded arguments, including noting a lack of clear communication.

FT Alphaville is here to (hopefully) make the case that wonky and paranoid are not mutually-exclusive descriptors. Let’s say it explicitly: it’s completely reasonable — sensible, even — to be concerned about CBDCs.

There are two overwhelming reasons for this:

— people should always be hesitant about potentially giving up rights to their government, even if they trust their government.

— even if people currently trust their government, they should operate on the basis that they may not always trust their government.

That’s enough undergraduate stuff — what has actually been said? We’re going to focus on Britain here, because:

— it’s the case we’re most familiar with

— Britain has a well-established and fairly decent democratic system, and an advanced financial system, creating probably the ideal conditions for an CBDC that isn’t ethically dead on arrival (by being, eg, explicitly a means of controlling the population)

Alphaville has already done a couple of big posts on ‘Britcoin’, the popular moniker for the digital pound CBDC being proposed by the Bank of England.

— The first one examined the BoE’s arguments for why it needs to create a digital pound (and found them lacking)

— The second one looked at the proposed system through which a digital pound could be utilised

We’d love for you to read them but tl;dr on the latter: BoE’s proposals are based around a wrapper system, in which Threadneedle Street develops a centralised ledger for transactions, and then third parties develop service applications (think banking or budgeting apps) that plug into that ledger.

We didn’t really look at the ethical side of things back then, because it’s all a bit intangible: at this stage, a lot of the things we ‘know’ about Britcoin are just us accepting official statements at face value.

But those statement are the key matter here. They create something that might be called a credibility vacuum, which is being exploited (can you exploit a vacuum?) by people trying to turn CBDCs into a wedge political issue.

Let’s get into the detail. Here’s a quote from the UK Treasury in the mainFT piece:

“Under these proposals, the digital pound will be as private as the card payments and bank accounts that millions use every day,” says the Treasury. “This means [neither] the government nor the Bank of England can access anyone’s personal data or see how people are spending their money.”

Useless. Rebuttal:

— “as private as the card payments and bank accounts” — tells us absolutely nothing, and indeed suggests they may not be very private at all: banks have to monitor transactions. PLUS society has come up with many delightful ways (cf landlord checks on tenants) in which people are forced to share intimate details from their accounts

— “This means [neither] the government nor the Bank of England can access anyone’s personal data or see how people are spending their money” — well, maybe, because that capability would be outsourced to the companies that provide the services, but that’s small comfort. It also does nothing to address one of the biggest concerns sceptics have: that a CBDC could be used to directly control spending.

Let’s double-click on that last point. This is about “programmability”, ie the idea that users or operators could set restrictions on how a digital currency is used. In the BoE’s main (non-technical) consultation paper on Britcoin, it says:

There are already examples of the direction in which the digital pound could support innovation through improved functionality for users, such as programmability. Technology is emerging that allows users to set rules to limit their spending on certain products, for example on gambling, or to automatically save a small amount of money after each purchase. This technology builds on existing, familiar applications like Direct Debit.

This paragraph is likely to draw one or both of the following reactions:

— “That sounds useful.”

— “If the government gets this power they could use it to control how I spend.”

Both are completely reasonable, but one is clearly a much more serious matter than the other (we’ll accept that in certain cases like controlling gambling spending, being able to impose such restrictions could be transformative for some people, but we doubt it would be a silver bullet).

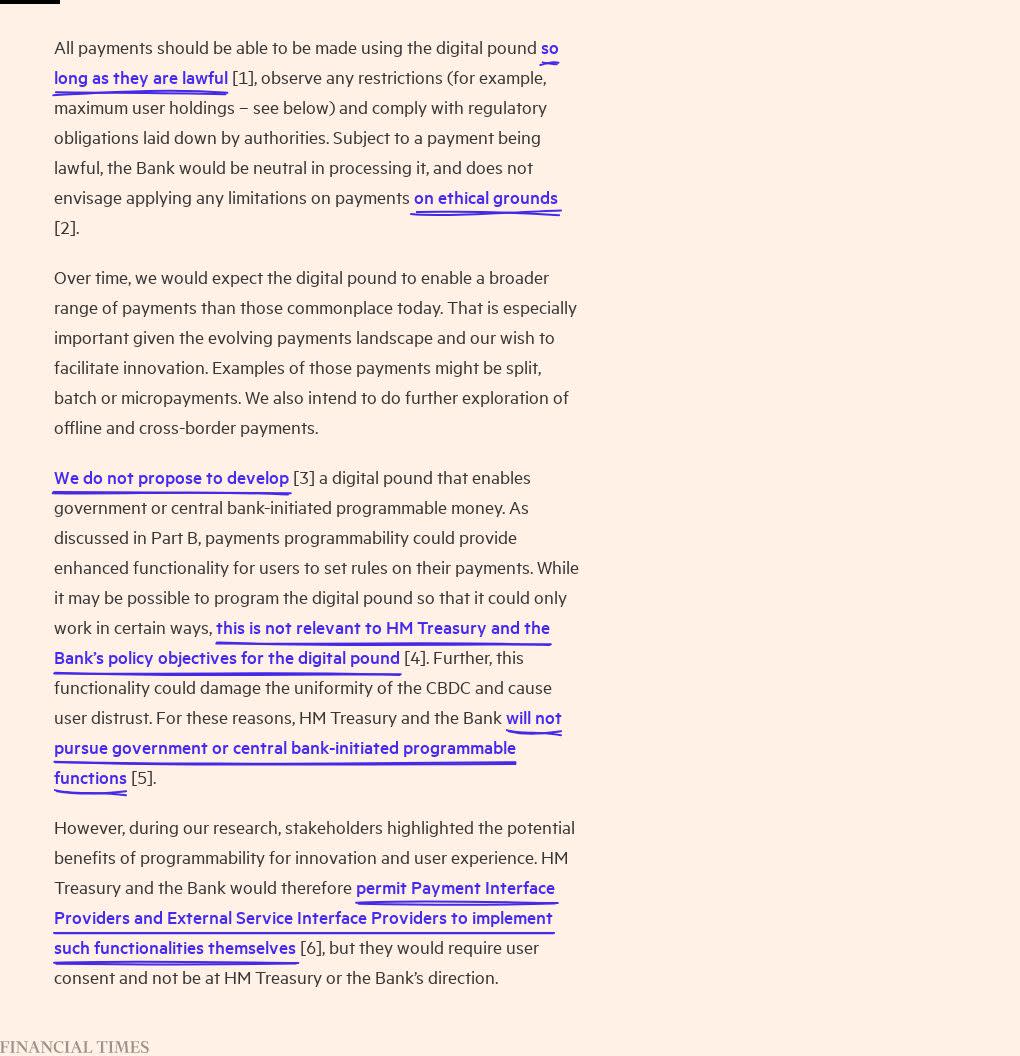

The consultation paper goes on to say that it doesn’t want to bake programmability in. Big block quote time (from pg. 78 of the consultation). If you click on the underlined text below you should be able to see our annotations, sorry if this is janky:

Some people might find this text reassuring, but we wouldn’t judge anyone who thinks the opposite.

Look, we don’t believe the government is trying to get rid of cash to bring about a new world order. We don’t think Andrew Bailey is a reptile (even if Mark Carney and Lex do). We don’t even think that handing the government the power to control how you spend your money would lead to them, you know, actually doing that.

But assurances are just that: assurances. And people have every right to be sceptical of assurances, especially from their government.

Ultimately, writing off fundamental concerns about CBDCs because they’ve becomes bedfellows with truly outlandish conspiracy theories doesn’t serve anyone well. If the BoE and Treasury insists on making Britcoin a thing, the onus is surely on them to make a vigorous case that genuinely addresses these concerns.

This article has been archived for your research. The original version from Financial Times can be found here.